Chapter 12 Accounting for Partnerships Test Bank

There are only four legal structures to form and operate a business. Examples of unearned revenues.

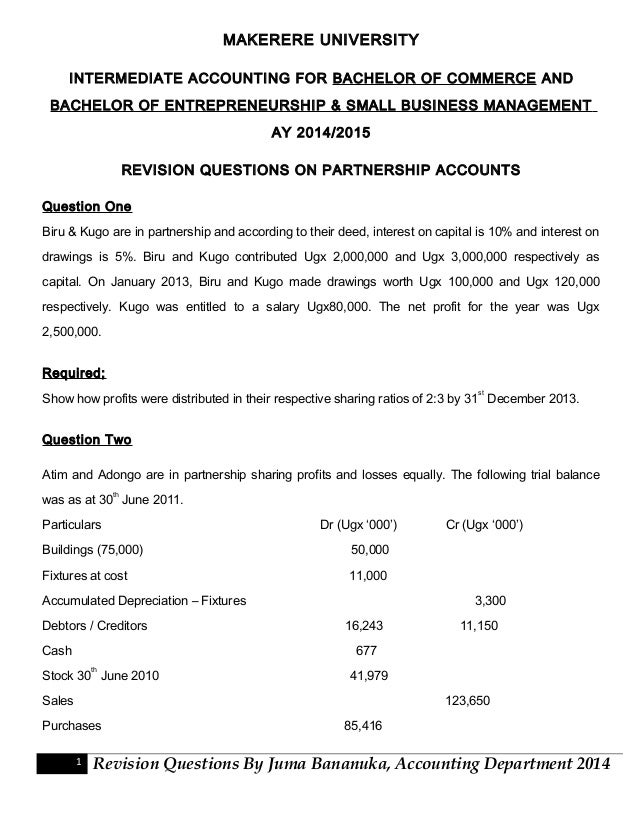

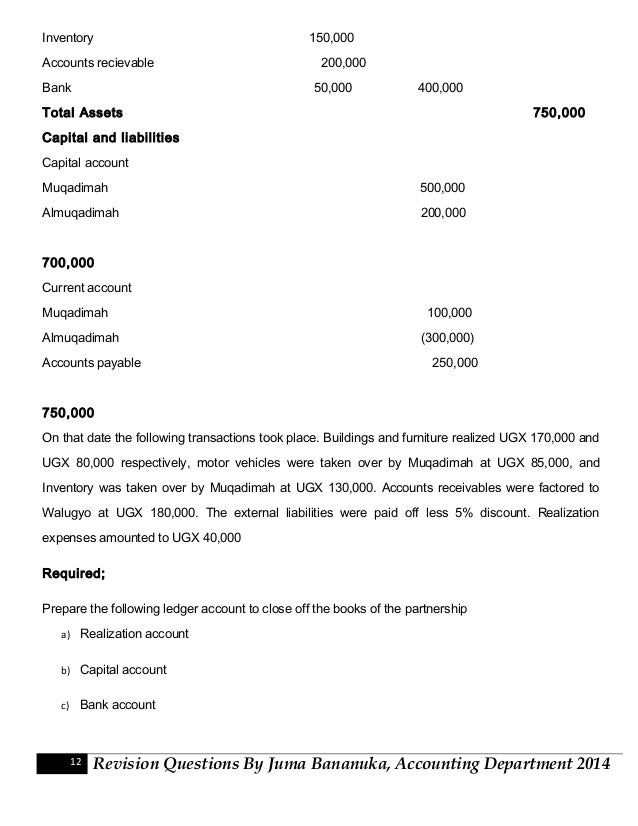

Partnership Revision Questions Ay 2014 2015

School Lahore School of Economics Lahore.

. In a general partnership each partner is individually liable to creditors for debts incurred by the partnership to the extent of the partners capital balance. CHAPTER 13 CURRENT LIABILITIES AND CONTINGENCIES IFRS questions are available at the end of this chapter. Preferably however the agreement should be in writing.

Chapter 12 accounting for partnerships 1. PARTNERSHIP AND CORPORATION ACCOUNTING TETSBANK PRACTICE MATERIALS chapter 12 accounting for partnerships summary of questions study objectives and taxonomy. FA Test Bankpdf - Chapter 12-Accounting for Partnerships.

Allocate gainloss on realization to the partners based on the income ratio 3. DK Goel Solutions Class 12 Accountancy Free PDF DK Goel Classy Classing 12 Solutions Part A Ã â Volume 2 Chapter 7. Test Bank Chapter 12 Accounting for Partnerships and Limited Liability Companies 1.

FA Test Bankpdf - Chapter 12-Accounting for Partnerships and Limited Liability Companies Student. Xem và tải ngay bản đầy đủ của tài liệu tại đây 117 MB 38 trang Chapter 12 Accounting for Partnerships PowerPoint Authors. CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS OVERVIEW There are three forms of business organization.

During the year 2006-2007 Rani withdrew Rs. Pages 416 Ratings 100 2 2 out of 2. In a general partnership each partner is individually liable.

A partnership is a voluntary association of two or more individuals based on as simple an act as a handshake. Accounting for Share Actions. His capital account will be credited for the amount of cash he invested C.

Scott Osborne The applicable law. Bạn đang xem bản rút gọn của tài liệu. Lecture Principles of financial accouting - Chapter 12.

- Selection from Problem Solving Survival Guide Volume I. 1 2 3 4 12 1 2. 10000 from her capital and Suman Rs.

1 Rani and Suman are in partnership with capitals of Rs 80000 and Rs. Explain the accounting entries for the formation of a partnership. Ch12 - CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS SUMMARY OF QUESTIONS BY LEARNING OBJECTIVES AND BLOOMS ch12 - CHAPTER 12 ACCOUNTING FOR PARTNERSHIPS SUMMARY OF.

Accounts relating to the capital of partners and cash Banca A C excluding fragmented distribution sale to a company and the insolvency of the partners. Accounting for the revenues expenses assets and liabilities is the same for. Exercises Problems Problems 1.

Pay partnership liabilities in cash 4. Chapter 12--Accounting for Partnerships and Limited Liability Companies Key 1. His capital account will be credited for more than the cash he invested B.

Partnership Act 1892 NSW The relevant law is contained in the Partnership. CHAPTER 12 Accounting for Partnerships ASSIGNMENT CLASSIFICATION TABLE Brief A B Study Objectives Questions Exercises Do It. 4 steps in liquidating a partnership 1.

A partnership agreement is an agreement between two or more individuals who sign a contract to start a profitable business together. Basic accounting test bank chapter 12 accounting for partnerships summary of questions study objectives and taxonomy item so bt item so bt item so bt item so. CHAPTER 12 Accounting for Partnerships ANSWERS TO QUESTIONS 1.

Account and other related accounts. Chapters 1-12 to accompany Accounting Principles 11th Edition Book. Profits before charging interest on capital was Rs.

Intermediate Accounting Test Bank Chapter 13. Impairment occurs when the carrying amount of the intangible asset is not recover-able. Proprietorship partnership and corporation.

Reporting discount on Notes. Sell noncash assets for cash and recognize a gain or loss on realization 2. Distribute remaining cash to partners on the basis of their remaining capital balances schedule of cash payments.

In the Partnership agreement the partners are equally responsible for the debt of an organisation. School University of California Los Angeles Course Title MGMT 1A Type Test Prep Uploaded By homie123 Pages 66 Ratings 91 241 This preview shows page 1 - 4 out of. Accounting Principles 12th Edition.

Subjects Essays Free Essays Book Notes AP Notes Citation Generator HOME Accounting for partnership chapter 12 test questions Accounting for partnership chapter 12 test questions Essays and. 431-440of 500 Free Essays from Studymode of Partnerships. Test Bank Chapter 12 Accounting for Partnerships and Limited Liability Companies.

Test bank Accounting 25th Editon Warren Chapter 6-Accounting for Merchandising Businesses Test bank Accounting 25th Editon Warren Chapter 16-Statement of Cash Flows Test bank Accounting 25th Editon Warren Chapter 17-Financial Statement Analysis. A bonus will be credited for the amount of cash he invested D. Chapter 12 Intermediate Accounting Test Bank Chapter 12 Intermediate Accounting Test Explain the Accounting Issues Related to Intangible-asset Impairments.

A bonus will be distributed to the old partners capital accounts. Chapter 12-2 ACCOUNTING FOR PARTNERSHIPS Accounting Principles Eighth Edition CHAPTER 12. Identify the characteristics of the partnership form of business organization.

5 1 2 2 3 1A 1B 3. Buy now to view the complete solution. There are only four legal structures to form and.

A Association of individuals. Ravi and Suman shared profits in the ratio of 32. Chapter 12--Accounting for Partnerships and Limited Liability Companies.

There are only four legal structures to form and operate a business. CHAPTER 12 Accounting for Partnerships ASSIGNMENT CLASSIFICATION TABLE Study Objectives Questions Brief Exercises Exercises A Problems B Problems 1. Companies use a recoverability test and a fair value test to determine impairments for limit-ed-life.

Course Title ACCOUNTING 112. When Nicks investment in the partnership is recorded A. Identify the characteristics 1 2 3 1 1 of the partnership form of 4 24 business organization.

CBSE Class 12 Accountancy Chapter 2 Important Questions QUESTION 1 Define Partnership.

Test Bank For E Commerce 2017 13th Edition By Laudon Ibsn 9780134601564 By Michael9130 Issuu

Test Bank For Macroeconomics 6th Edition By Williamson Ibsn 9780134472119 By Grucm Issuu

Partnership Revision Questions Ay 2014 2015

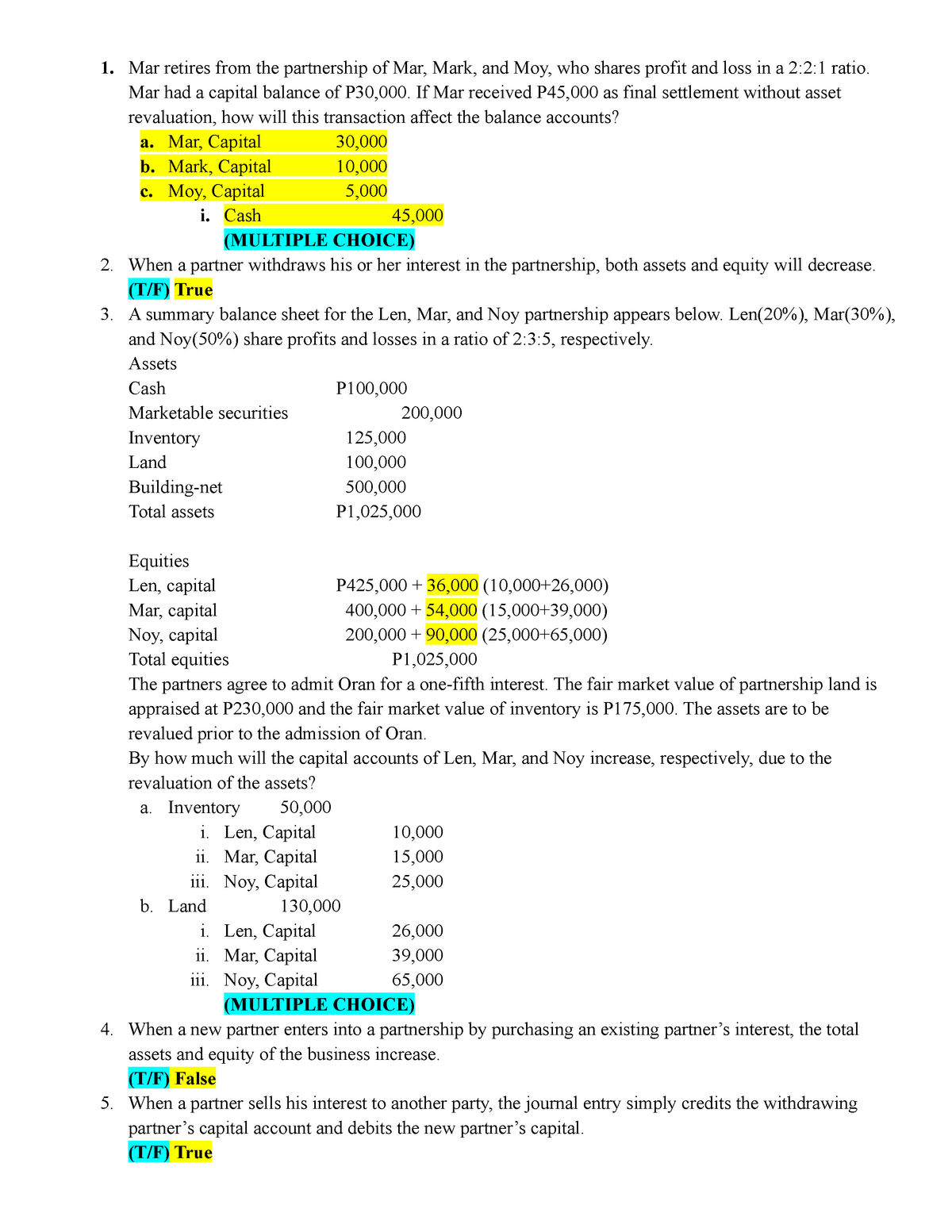

Partnership And Corporation Practice Exam Mar Retires From The Partnership Of Mar Mark And Moy Studocu

No comments for "Chapter 12 Accounting for Partnerships Test Bank"

Post a Comment